What is the Sustainability Accounting Standards Board (SASB) and how does it work?

Looking to make informed decisions about sustainability performance?

The Sustainability Accounting Standards Board (SASB), a non-profit developing sustainability accounting standards for companies in various industries, provides a framework for reporting on financially material sustainability information that is important to investors.

SASB has recently been integrated into the International Sustainability Standards Board (ISSB), after having previously merged with the International Integrated Reporting Council (IIRC) to form the Value Reporting Foundation (VRF).

In this article, we'll explore how SASB works and the benefits of using its standards.

Learn how companies can use SASB to improve their sustainability reporting, and how investors can make better decisions based on companies' sustainability performance!

By the end of this article, you'll have a solid understanding of the SASB and the role it plays in driving sustainability disclosure in the corporate world.

How do the SASB Standards work?

Methodology

The SASB Standards takes a topic specific approach to ESG reporting. The SASB Standards cover 77 different industries and identify subsets of environmental, social, and governance issues within each of said industries.

This structure is specifically designed to help companies disclose financially-material sustainability information; thus, the SASB Standards adhere to a financial materiality (rather than double materiality) approach.

The SASB Standards provide the following components for each industry standard: standards application guidance, a list of disclosure topics, accounting metrics, activity metrics, and technical protocols aimed at making data standardised and comparable. Examples of material issues and metrics for SASB’s industry-specific approach can be found here.

SASB Standards are often used in conjunction with the GRI Standards, as the two sets of Standards have divergent but complementary approaches (SASB focuses on financially material information and GRI focuses on stakeholder impacts).

SASB Standards are especially useful for more granular topics as they provide key performance indicators (KPIs) and metrics related to climate risks and opportunities that are tailored for industry-specific concerns. The SASB Standards are free to download for non-commercial use.

{{encartSpecial}}

Key concepts and principles

The SASB Standards define sustainability as “corporate activities that maintain or enhance the ability of a company to create long-term shareholder value”. Sustainability accounting is the measurement, management, and reporting of said activities.

The VRF groups sustainability-related activities into five different dimensions:

- Environment

- Human capital

- Social capital

- Business model and innovation

- Leadership and governance.

Tools and resources

The SASB Standards provides a wide array of resources to help companies determine and meet their needs.

The list below links to some relevant pages that companies may want to explore in the process of their sustainability reporting (this is not an exhaustive list).

- SASB Implementation Primer

- Sustainable Industry Classification System® (SICS®)

- SICS Look-Up Tool: where companies can look up their primary industry classification within SICS and download the corresponding industry standard. Note that at this time, companies are only given one primary classification, but can decide themselves to use multiple industry standards if the case calls for it.

- SASB Materiality Finder: the Materiality Finder allows users to search up companies by name, ticker, or ISIN. Results will show a brief description of the company’s mission, the industry that the company works in, and a list of relevant issues and disclosure topics (see images below). Clicking on the ‘see disclosure topics’ button leads to a page with more detailed information.

- Standard-Setting Archive: find supporting materials related to the development of the SASB Standards

- Database of investors that use the SASB Standards

- SASB Engagement Guide (for Asset Owners & Managers)

Who uses the SASB Standards, and why?

All organisations can use the SASB Standards, as there are no strict requirements on who may use the framework.

However, due to the topic-specific nature of the SASB Standards, they are most commonly utilised by investors and private companies.

The VRF page on global use of SASB standards states that “[m]any types of market participants, including companies, advisors, and others, support and use SASB via becoming members of the SASB Alliance and/or licensing SASB Standards”.

SASB is used globally, and according to a 2021 SASB report, “[m]ore than 225 asset owners and asset managers, representing approximately $72 trillion in assets under management across Asia, Europe, the Middle East, North America, and South America participate in the SASB Alliance, or have licensed SASB Standards for use in investment tools and processes”.

SASB is mainly used by companies and investors to assess the material issues of a specific industry/company, and to identify expected metrics.

The SASB Standards help companies benchmark with industry peers by providing guidance on which material issues and key metrics to focus on and report out on.

Companies will commonly include a SASB Correspondence Table in their Sustainability or CSR Report to indicate how they used the Standards, and to further explain quantitative and qualitative data in the report.

On the other hand, investors may use the SASB Standards to assess, compare, and further understand their portfolios.

SASB Standard guidance provides investors with additional context on industry standards (ie. informs investors of the ESG reporting norms within a specific industry), thus allowing investors to identify leaders and laggards within their portfolio, and better understand risks and opportunities.

Benefits of using the Standards

The biggest benefit of the SASB Standards specifically (also the biggest limitation) is that they are industry specific.

Material issues vary by industry, so industry-specific disclosure guidance is time- and cost-effective and reduces the reporting burden by honing in on the most relevant issues. On average, each SASB industry standard includes 6 disclosure topics and 13 accounting metrics.

Also, sustainability reporting in general, with any standard, confers a number of benefits.

Companies that produce high quality sustainability reports are more likely to enjoy a positive reputation in the eyes of stakeholders and the general public, as compared to competitors who do not produce sustainability reports. Sustainability reports also provide vital information on material issues and help support overall risk assessments.

This was shown by a 2015 Harvard working paper (“Corporate Sustainability: First Evidence of Materiality”) that tracked the performance of 2,307 unique firms over 13,397 unique firm-years across 6 sectors and 45 industries, ultimately finding that firms that addressed financially material sustainability factors had significantly higher accounting and market returns.

Finally, as the VRF stresses, ESG reporting is increasingly necessary to meet investor needs and expectations. Investors are recognising the need for comparable, consistent, and reliable data, and see the SASB Standards as one tool for achieving quality disclosure.

Investors benefit from SASB Standard usage as well; the Standards enable companies to provide comparable, consistent ESG data, which in turn gives investors a clearer understanding of a company’s prospects and enables them to make more informed decisions.

The VRF states that investors have “historically lacked access to comparable, standardised data they need to inform their decisions,” and markets the SASB Standards as a tool for integration and communication of ESG considerations (in investment and stewardship decisions).

How to apply the SASB Standards

Process overview

The SASB Standards provides an Implementation Primer that walks companies through reporting and communicating with investors with the SASB Standards. A graphic of the suggested steps to link sustainability to business performance is shown below.

1. Establish a foundation

- Set the tone with company leadership—speak with the Board of Directors and executive leadership to establish buy-in.

- Build capacity by assembling a sustainability reporting team, and mapping knowledge bases and skill sets

2. Choose tools

- Develop an understanding of the frameworks and standards available

- Develop disclosure and communication objectives (identify and prioritise target audiences)

- Understand audience needs and expectations by engaging with target audiences and reviewing peer disclosure to better understand information needs and expectations

- Select the right framework for the company’s needs

3. Decide where to disclose

- Understand required disclosures (will differ according to region/country, as well as industry)

- Understand the parameters of voluntary reporting and consider the disclosure channels available

4. Understand SASB Standards

- Become familiar with SASB terminology and the SASB standards themselves

- Determine which industry standards apply

- Determine which disclosure topics apply

5. Assess readiness

- Review SASB metrics

- Perform a gap analysis to understand whether/how the company is currently reporting sustainability information, as well as whether/how it is collecting data

- Confirm the reliability of said data and/or current procedures

6. Develop disclosures

- Determine presentation format—consider how relevant data can be best presented to investors

- Provide context for disclosure topics and metrics

- Disclose omissions and modifications of disclosure topics and/or accounting metrics

- Review the overall narrative

7. Enable continuous improvement

- Monitor the driving factors influencing ESG risk/opportunity

- Monitor market practices around each relevant disclosure topic (peer disclosure, stakeholder engagement, disclosure requirements and recommendations)

- Keep track of SASB Standards updates

- Monitor performance on SASB metrics

There is no audit phase, and no set timeline for this process.

The SASB Standards are a voluntary framework to aid in sustainability reporting, and issues recommendations for best practices, rather than requirements.

As with most other frameworks, there is no universally accepted, official verification process for confirming the quality of reports created in line with the SASB Standards.

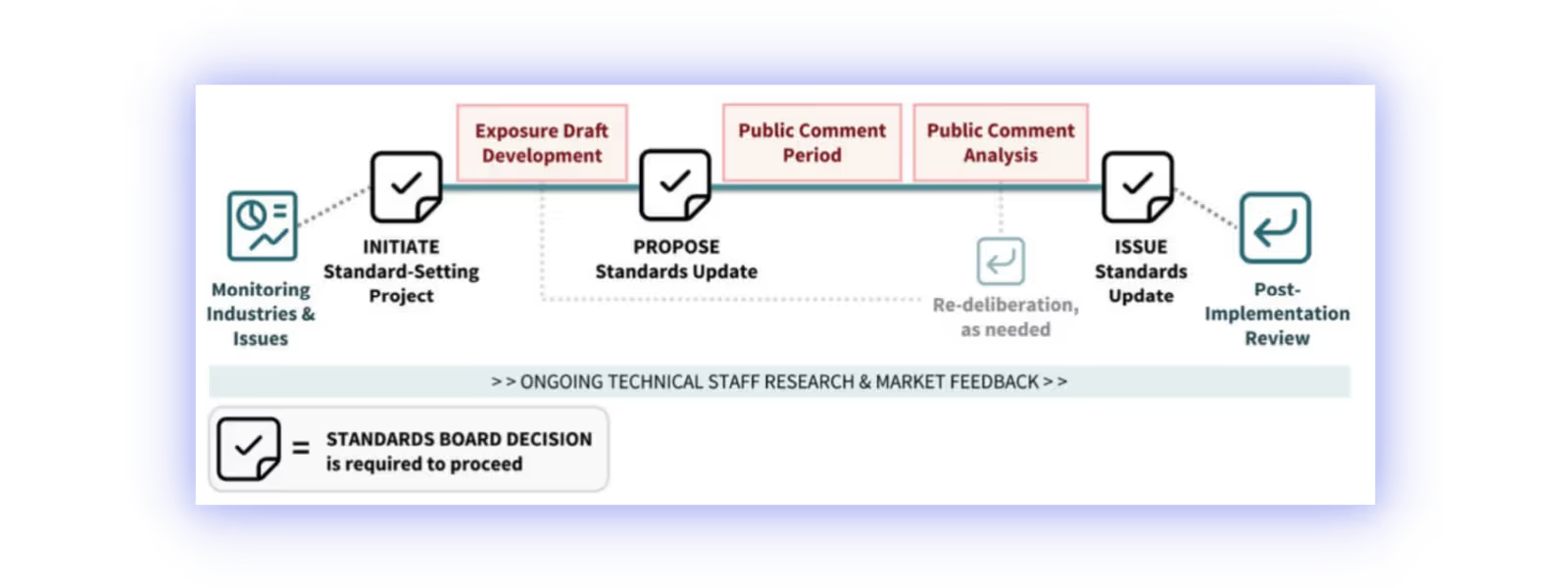

However, do note that the SASB updates its Standards via a project-based model (process shown in the diagram below), so regularly checking the SASB Standards and metrics for updates is recommended.

Options for facilitation and aid from third-parties

With Apiday, it’s easier than ever to align your reporting with any ESG framework! Including SASB Standards.

Our AI-driven technology gathers all your sustainability data in one place and automates the reporting process:

- on the Apiday platform, you’ll find a list of documents to share

- upload as many as you can find

- and we’ll pre-fill your sustainability report and provide you with a correspondence table;

while our experts assist you along the way with tailored ESG consulting support.

Save yourself time and hassle, and let Apiday do the rest!

Maximise your SASB standards alignment with minimal effort - it's possible!

Streamline your ESG disclosure, save time, and reduce errors with our AI-powered reporting tool. Consolidate all your sustainability data in one place and generate comprehensive reports effortlessly, freeing up time for more strategic tasks. Enhance competitiveness and productivity while contributing to a sustainable future, start today!

Frequently Asked Question

SASB is a non-profit organisation that creates industry-specific sustainability accounting standards for publicly listed companies. The standards help investors make informed decisions and improve corporate sustainability performance by promoting standardised, comparable disclosure of material sustainability issues. SASB has recently been integrated into the International Sustainability Standards Board (ISSB).

SASB develops industry-specific sustainability standards for public companies to improve material disclosure. GRI provides a wider framework for sustainability reporting that can be used by any organisation, enabling reporting on a range of sustainability topics. Both aim to promote sustainability reporting, but SASB provides industry-specific standards while GRI offers a more general framework and dedicated frameworks for some industries.

SASB develops 77 industry-specific standards that reflect sustainability issues likely to impact a company's financial performance. These are created through a rigorous, stakeholder-inclusive process, and are designed to be decision-useful and financially material. The ultimate goal of the SASB framework is to provide guidance on integrating sustainability reporting into financial reporting and assessing materiality, with the goal of improving the comparability and quality of sustainability information for investors to make more informed decisions.

Related articles

What is CSR (Corporate social responsibility) and how to adopt it?

CSR is an abbreviation for Corporate Social Responsibility. CSR strategies have become common in today’s corporate world as more and more companies realise that their business performance and its societal impacts are intricately connected.