CSRD Compliance Checklist: A Complete Guide to Achieving CSRD Reporting

The Corporate Sustainability Reporting Directive (CSRD) is the European Union’s regulatory framework designed to enhance and standardise sustainability reporting across industries.

By building upon the Non-Financial Reporting Directive (NFRD), the CSRD significantly expands the scope of companies required to disclose detailed environmental, social, and governance (ESG) information.

The main objectives of the CSRD are to promote greater transparency and accountability within the corporate sector, ensuring that companies provide consistent, reliable, and comparable ESG data to stakeholders, investors, and regulatory bodies.

To help you navigate these requirements, we’ve outlined an eight-step checklist to guide you through the preparation process:

1. CSRD Eligibility Criteria: Who Needs to Comply?

The first step is to determine whether your business falls under the scope of the CSRD. This initial evaluation is crucial in forming your compliance strategy, as ambiguity about your obligations can lead to delays and potential penalties.

Who is affected by the CSRD?

The CSRD broadens the range of companies that must report on sustainability compared to the Non-Financial Reporting Directive (NFRD). Businesses now subject to the CSRD include:

- Large companies: Organisations that meet at least two of the following criteria:

- More than 250 employees;

- More than €40 million in revenue;

- A balance sheet total exceeding €20 million.

- Publicly listed companies, including small- and medium-sized enterprises (SMEs) listed on regulated markets, with the exception of micro-enterprises.

- Non-EU companies: entities generating over €150 million in turnover within the EU and having at least one subsidiary or branch in the EU.

Defining the scope of CSRD obligations

Clearly define the reporting perimeter before proceeding. This scope includes the parent company, its subsidiaries, and other relevant entities such as joint ventures.

For multinational corporations, this often involves analysing both EU and global operations to understand the full extent of reporting responsibilities.

Subsidiaries are typically included in the parent company’s CSRD report, but those that meet specific criteria or are not fully covered by the parent report may be required to submit their reports.

CSRD timeline: key deadlines for different businesses

CSRD compliance is phased in over time, with varying deadlines for different types of businesses:

- 2024: Companies already under the NFRD will begin reporting in compliance with the CSRD, covering their fiscal year 2023.

- 2025: Large companies previously not covered by NFRD will begin their CSRD reporting.

- 2026: Listed SMEs and other eligible entities, must comply with CSRD requirements.

- 2028: Non-EU companies generating over €150 million in the EU and having a subsidiary or branch in the EU will be obligated to comply with CSRD.

.avif)

Learn more about CSRD’s timeline here.

2. CSRD Requirements: What You Need to Report

This phase requires familiarisation with the types of data that need to be disclosed, the required presentation format and the expected scope or depth of information.

The level of detail mandated by the CSRD can seem daunting, especially for companies that are not used to this level of transparency. Reports must not only present historical data but also explain how the company plans to improve its sustainability performance, demonstrating alignment with the company’s overall strategy and long-term objectives.

Learn more about CSRD’s requirements here.

Overview of European Sustainability Reporting Standards (ESRS)

At the heart of the CSRD are the European Sustainability Reporting Standards (ESRS). These standards provide a framework for how companies should disclose their sustainability-related data, outlining specific metrics and qualitative information covering a broad spectrum of ESG factors.

One key challenge businesses face is the extensive volume of data points encompassed by the ESRS—over 1,000 across multiple categories. Understanding the interplay between these data points is crucial, as they often overlap or influence one another, adding complexity to the reporting process. Effective management of these relationships is essential for coherent and comprehensive sustainability reporting.

{{encartSpecial}}

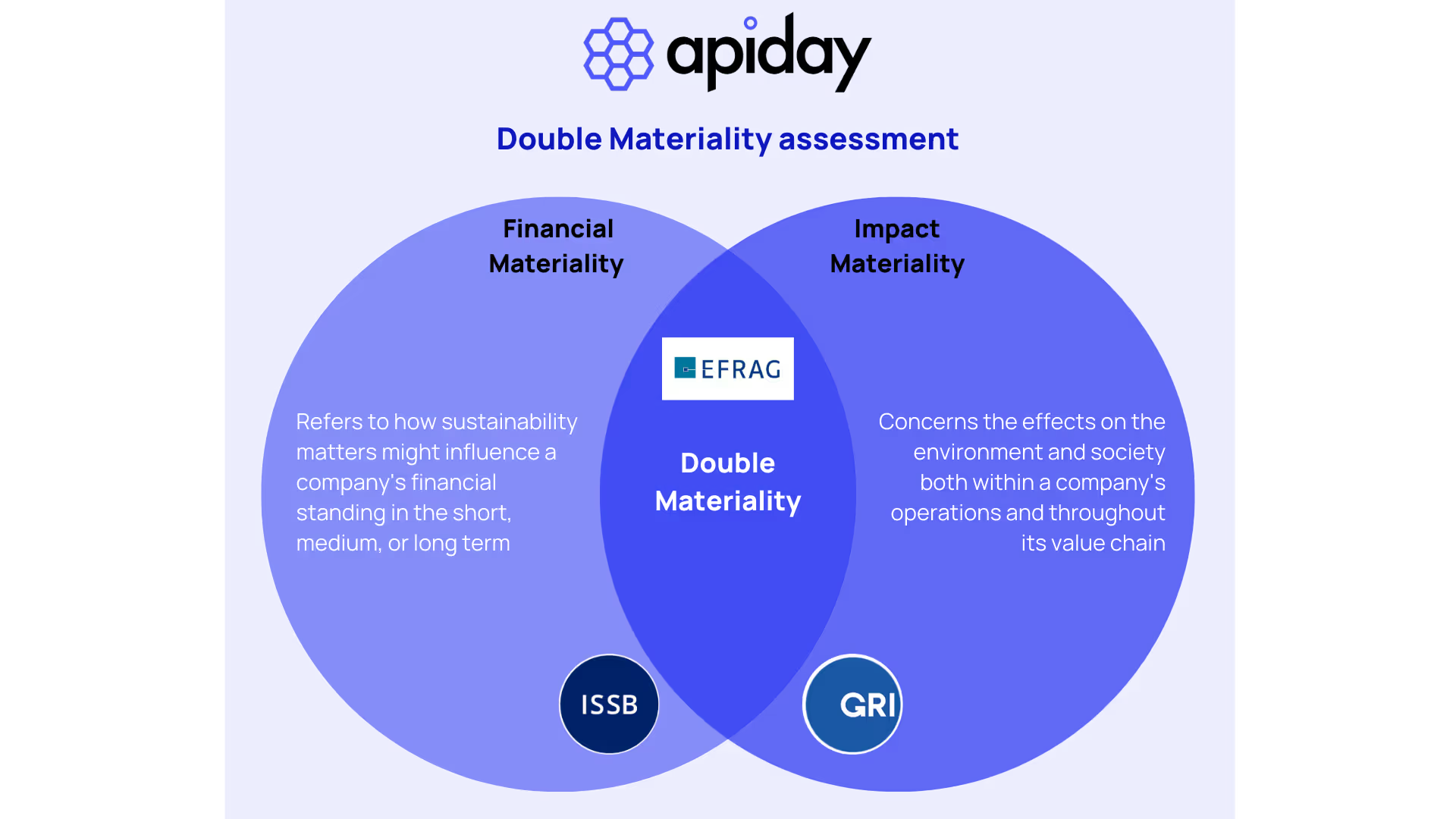

Double Materiality: financial and impact materiality

The concept of double materiality is foundational to CSRD reporting, transcending the traditional approach to materiality in financial reporting. Companies must assess and report on two dimensions of materiality:

- Financial materiality: This involves evaluating the risks and opportunities posed by sustainability factors to a business. These businesses or companies should consider how environmental and social factors may impact their financial health and long-term viability.

- Impact materiality: This dimension examines the effects of a company’s operations on the environment and society. Businesses must assess how their activities contribute to climate change, resource depletion, human rights, and more.

ESG data collection for CSRD compliance: third-party verification

Historically, sustainability reporting has been largely voluntary and self-regulated. However, the CSRD mandates independent audits of reported ESG data to enhance credibility and reliability.

The third-party verification process resembles financial audits. Independent auditors will review the company’s sustainability reports to confirm that the data is accurate, complete, and aligned with the ESRS requirements. This includes verifying that appropriate methodologies were used for data collection and analysis, and ensuring there are no errors or omissions.

Engaging with third-party auditors as early as possible is crucial. This proactive approach allows you to understand their expectations and ensures your processes align with their evaluation criteria. Preparing in advance will streamline the verification process and help prevent delays.

Learn how to prepare for CSRD’s auditing here.

3. Assess Your Company’s Standing

Once your company ascertains it falls under the scope of the CSRD and understands the key reporting requirements, the next key step is to evaluate its readiness.

This assessment involves a thorough assessment of your company’s existing data, reporting practices, and workforce capabilities to identify gaps and areas for improvement. The goal is to create a clear path toward compliance, ensuring your business is well-prepared to meet CSRD requirements.

- State of your data: Assess whether your company already tracks the necessary data required by the CSRD. Is your data collection comprehensive and reliable? For instance, do you have clear metrics for carbon emissions, energy consumption, or social initiatives? If your data is incomplete or scattered across various departments, now is the time to establish a more centralised and consistent data management system.

- Current reporting practices: Evaluate your existing eporting methods. Assess the level of details of your company’s reports and if they align with the existing ESG frameworks and regulations. This can provide a foundation for your CSRD reporting, but you will likely need to refine and expand your disclosures to meet the ESRS requirements.

- Workforce readiness: Examine the capacity and expertise of your workforce to handle the CSRD requirements. Do you have the right talent and resources? Effective sustainability reporting under CSRD demands collaboration across functions, including finance, legal, sustainability, HR, and operations. If skill gaps exist—whether in technical knowledge or reporting expertise—you’ll need to address these quickly, either by hiring new staff or upskilling your current team.

Invest time in educating your team about the CSRD framework and ESRS, as they may not all be familiar with sustainability reporting. Internal workshops or external training sessions can be useful in building a common understanding and ensuring alignment.

Finally, set realistic deadlines and milestones for each phase of your CSRD compliance journey. Define short-term goals and gradually work toward more complex tasks, leading to the finalisation of your company’s CSRD report.

4. Conduct your Double Materiality Assessment

Conducting a double materiality assessment is a cornerstone of the CSRD compliance process.

In-house vs. Consultant-led assessments

You can conduct a double materiality assessment in-house or enlist external consultants, depending on your company’s resources and expertise.

- In-house assessments: If you have a skilled sustainability team with deep knowledge of your business operations and industry, conducting the assessment internally can be cost-effective.

- Consultant-led assessments: For companies new to sustainability reporting or with limited internal resources, hiring sustainability consultants may be the most efficient route. External consultants bring specialised expertise in materiality assessments and can provide an objective, third-party perspective, ensuring all relevant factors are considered and findings are aligned with the ESRS.

After evaluating financial and impact materiality, rank the issues based on their significance. This ranking will help you focus on the most material sustainability topics for your CSRD reporting. Issues scoring highly in both dimensions require particular attention, although even those ranking highly in only one may still warrant inclusion in your disclosures.

Once you have a clear view of your company’s most material ESG issues, determine which ESRS are apply to your report. This step can be challenging, as companies may struggle to keep track of the connections between various disclosure requirements, leading to confusion and inefficiencies in reporting.

At Apiday, we automatically identify the applicable ESRS standards based on your materiality assessment and generate ESRS questionnaires for you to fill, simplifying the reporting process and ensuring full compliance with regulatory requirements.

5. Prepare for Data Collection and Report

Data collection can be challenging, especially for large companies with multiple departments, external partners, or international operations. Key considerations include:

- Internal data sources: Many relevant ESG metrics—such as energy usage, waste management, human resources data, or governance policies—are often scattered across various departments, including operations, finance, HR... Mapping where each type of data is stored and ensuring each department understands its role in the reporting process is crucial.

- External data sources: Some critical data may be held externally by third-party suppliers, contractors, or consultants. For example, if you rely on third-party providers for emissions data or supply chain management, coordinate with these partners to ensure timely and accurate delivery of the required information.

- Assigning data owners: For every key data point, designate a data owner—a person or team responsible for collecting, maintaining, and verifying the information. This fosters accountability, ensuring that no data point is missed and that the quality of the information remains consistent.

Defining and implementing proper controls is essential to prevent errors, duplications, or discrepancies in the data. These controls might include automated validation checks to flag inconsistencies, review processes for manual entries, and regular audits of the data collection process to ensure robustness.

For many companies, managing large datasets manually is impractical and prone to human error. A centralised data management system with automated features reduces the likelihood of mistakes and improves overall efficiency. A well-structured system ensures smooth data flow from various departments to a single reporting entry, making it easier to track progress and prepare your CSRD report.

Apiday simplifies data collection with its powerful tools: connect APIs, upload your documents & spreadsheets and launch company-wide campaigns to gather all relevant data.

6. Perform a CSRD Gap Analysis

Once the reporting process begins, regularly evaluating your progress is vital. Conducting a gap analysis helps pinpoint areas where your company may be lacking and guides you in addressing those shortcomings.

Manually conducting a gap analysis can be time-consuming and error-prone, but Apiday automates the entire process. Our platform identifies missing data points by comparing your pre-existing disclosures with the complete set of ESRS requirements, providing an instant overview of where your report falls short—without the need for manual cross-checking of each metric.

Apiday tracks your progress in real-time, allowing you to see how much of the gap has been filled. This keeps you on schedule and ensures your report is moving toward full compliance.

A gap analysis is not a one-time exercise but a continuous process. Even after addressing initial gaps, regularly reassess your position to ensure your reporting remains aligned with evolving CSRD requirements. As the reporting process moves forward, there may be new data or developments within your company that need to be incorporated into your report.

7. Draft a Ready-for-Audit CSRD Report

After gathering your ESG data, performing a gap analysis, and ensuring your report aligns with the ESRS, the final task is to draft your ready-for-audit report.

Every key performance indicator (KPI) in your report must link to its original data source. Additionally, document the methodologies used to calculate these figures—such as how emissions are measured or how social impact is quantified. This documentation ensures auditors can easily trace each data point back to its origin, verifying that no information is left unconfirmed.

Another key requirement for CSRD compliance is the digital tagging of reports using XBRL (eXtensible Business Reporting Language). Digital tagging allows regulatory bodies and auditors to read and process your report in a standardised format, facilitating easier data analysis, comparison and verification.

In the traditional approach, applying digital tags to a report can be complex. Each data point must be tagged according to the relevant ESRS to ensure it is machine-readable and fully auditable. Without proper tools, this task requires significant effort and attention to detail, increasing the chances of inaccuracies.

Moreover, the CSRD is not static; sector-specific standards and updates are continuously being developed. These evolving standards may require changes or additional disclosures in your report based on your industry. For example, specific requirements for the energy or financial sectors may not yet be fully incorporated into the general ESRS framework but will become mandatory in future reporting cycles.

Apiday: your partner for end-to-end CSRD compliance

Crafting a CSRD report is very demanding, but Apiday supports you through various steps of the process, significantly speeding up the workflow and improving efficiency in generating a ready-for-audit report.

Here’s how Apiday assists you in the final step:

- Apiday generates a full narrative CSRD report based on collected data, aligned with the relevant ESRS. You can make final edits and branding adjustments to tailor it to your company’s needs.

- Apiday takes care of the XBRL tagging, ensuring your report meets the digital requirements for submission.

- Apiday links each data point to its source and ensures full calculation transparency, allowing auditors to easily track each piece of information back to its source. This enhances the audit process' efficiency and reduces the likelihood of delays or issues during verification.

- Many auditors are already familiar with the Apiday platform. You can invite auditors with view-only permissions to access your reporting. We also provide them with a CSRD methodological note to get them up to speed.

Taking a clear and structured approach is essential for setting your company up for success. From determining your eligibility and understanding requirements to conducting double materiality assessments and establishing data collection systems, each step is vital for ensuring full compliance with the CSRD.

The introduction of XBRL tagging adds another layer of complexity, but with the right tools in place, this can be handled efficiently.

As regulations continue to advance, adopting the right technology that adapts to these changes will keep your company compliant and ahead of the curve.

If your company must comply with CSRD, you should begin immediately!

Our cutting-edge tool is here to guide you on the right compliance track, gathering data and automating the creation of disclosure reports. With everything you need to be fully compliant in a single platform, take the first step towards CSRD compliance now!

Frequently Asked Question

The Corporate Sustainability Reporting Directive (CSRD) is the European Union’s regulatory initiative to enhance and unify sustainability reporting standards across sectors. By mandating comprehensive disclosure on environmental, social, and governance (ESG) factors, the CSRD aims to improve transparency and ensure that companies provide reliable, comparable data for stakeholders, regulatory bodies, and investors. This framework helps align companies with sustainability goals, supporting the EU’s broader climate and social commitments.

While the NFRD applied to a narrower range of companies, the CSRD expands this to include more businesses and adds rigorous requirements for data quality, consistency, and format. It introduces the European Sustainability Reporting Standards (ESRS), which outline specific ESG metrics that companies must report on, covering various environmental and social dimensions. Additionally, the CSRD requires third-party audits to verify ESG data, a significant shift from the largely self-regulated NFRD, enhancing the credibility of sustainability reports.

Compliance with the CSRD applies to a broader scope of companies compared to the NFRD. Large companies that meet at least two criteria—more than 250 employees, over €40 million in revenue, or a balance sheet exceeding €20 million—must comply. Publicly listed small- and medium-sized enterprises (SMEs) on regulated markets (excluding micro-enterprises) are also included. Moreover, non-EU companies with EU-based subsidiaries or branches generating over €150 million in EU turnover fall under CSRD obligations, highlighting the directive’s extensive reach.

Sources

Related articles

What is CSR (Corporate social responsibility) and how to adopt it?

CSR is an abbreviation for Corporate Social Responsibility. CSR strategies have become common in today’s corporate world as more and more companies realise that their business performance and its societal impacts are intricately connected.