Corporate Sustainability Reporting Directive: all you need to know

The Corporate Sustainability Reporting Directive is a European Union law with a significant bearing on how organisations report their environmental, social and governance (ESG) performance.

The CSRD was introduced on January 1, 2020, and includes within its scope of reporting directive all the organisations that have a listing on a regulated market in the European Union or that reach certain thresholds (number of employees, turnover, balance sheet).

The new directive will require organisations to publish information about their environmental impact, social and economic performance, as well as governance practices.

The reports will need to highlight the risks and opportunities associated with these areas.

In this article we explain what the directive is, who it affects and the steps you can take to prepare for its enforcement.

Background

Aligned with EU’s goal of becoming net-zero by 2050, the European Commission recognises that private capital must be directed toward green, sustainable projects.

The Commission believes that investors must have direct exposure to complete and coherent information on their potential investees, including information on environmental practices, social responsibility and governance mechanisms.

The Corporate Sustainability Reporting Directive (CSRD) serves as a legislative tool facilitating the transition towards a more sustainable society, aiming to fill in the gaps in sustainability reporting.

It complements two other regulations which go in the same direction: the Sustainable Finance Disclosure Regulation (SFDR) and the EU Taxonomy.

Overall, the CSRD will supersede and complement the Non-Financial Reporting Directive (NFRD). Directive 2014/95/EU sets forth the regulations on disclosure of non-financial and diversity data by certain major firms.

NFRD came into force in all EU member states in 2018. All 27 nations had subsequently adopted the Directive into national legislation, and it is now up to corporations to comply.

It compels some major corporations to provide a non-financial statement as part of their yearly public reporting responsibilities.

With the NFRD, the European Union aimed to accomplish two major goals: make non-financial information about a company’s value creation as well as its risks available to stakeholders and investors, and effort to improve to assume accountability for social and environmental concerns.

From NFRD to CSRD

The Non-Financial Reporting Directive’s reporting requirements set critical criteria for some major corporations to report on their sustainability performance on an annual basis.

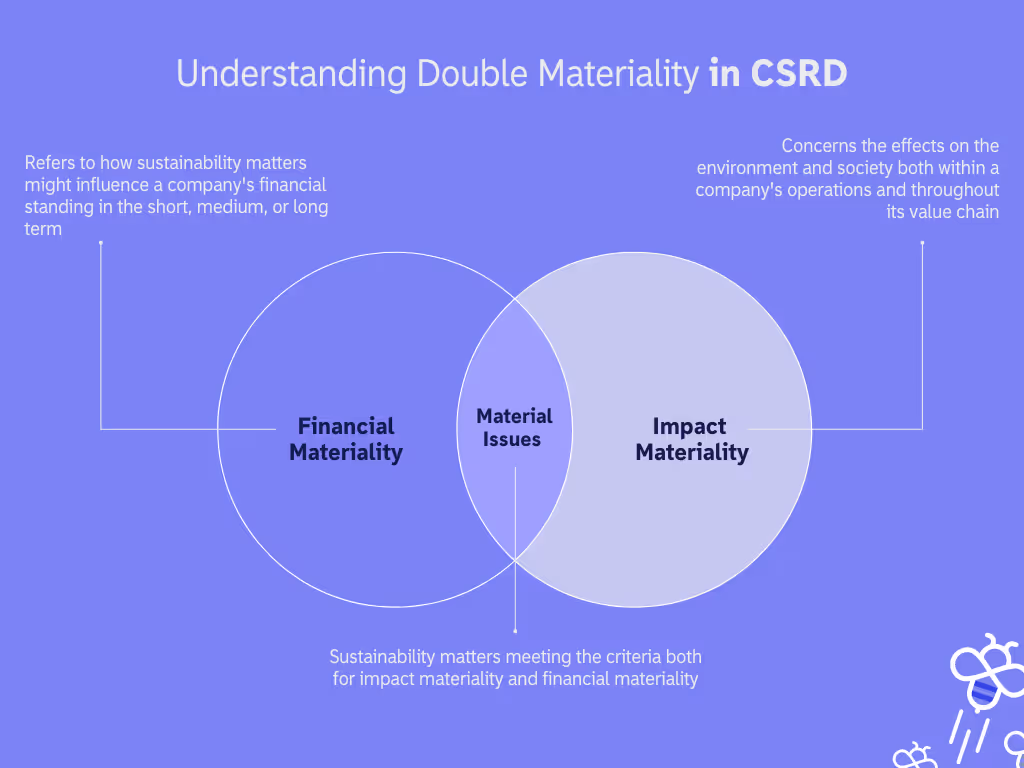

It established a double materiality viewpoint,’ which requires businesses to report on the effect of sustainability challenges on their operations as well as their own impact on people and the environment.

Nonetheless, abundant evidence was shared that the data provided by businesses is insufficient. Investors and other stakeholders often believe that reports exclude critical information.

Comparing reported data from one organisation to another may be difficult, and users of the data are sometimes uncertain about its reliability. Quality issues in sustainability reporting have a cascading impact.

As a result, investors lack a comprehensive perspective of the sustainability risks exposed to businesses.

Investors are becoming more interested in the social and environmental effect of businesses.

They need this knowledge in part to comply with the Sustainable Finance Disclosure Regulation’s own disclosure obligations.

More broadly, investors must understand the sustainability effect of the firms in which they participate if the market for green investments is to be viable.

Without such information, funding for ecologically beneficial initiatives cannot be directed.

Finally, deficiencies in reporting quality create an accountability chasm.

Companies that provide high-quality and dependable public reporting will contribute to the development of a more effective disclosure ecosystem.

CSRD precisely aims to dramatically broaden the scope of the NFRD while also increasing the transparency of business progress in terms of long-term sustainability and environmental protection.

Who establishes CSRD reporting standards?

The full requirements of the reporting duties under the CSRD will be specified in the new sustainability reporting standards that are currently being finalised under the supervision of the European Financial Reporting Advisory Group (EFRAG), which is a private organisation founded in 2001 at the European Commission’s request to serve the public interest.

In this process, EFRAG seeks technical guidance from various organisations:

- The European Environment Agency

- The European Banking Authority

- The European Securities and Markets Authority

- The European Insurance and Occupational Pensions Authority

{{encartSpecial}}

CSRD, SFDR and the EU Taxonomy

The CSRD may be seen as one of three EU rules governing sustainability reporting, alongside SFDR and the EU Taxonomy. The Sustainable Finance Disclosure Regulation (SFDR) came into force in March 2021.

By standardising sustainability disclosures, the SFDR aims to assist institutional investors and clients in understanding, comparing, and monitoring the sustainability features of investment funds.

The EU Taxonomy Regulation was published in the European Union’s Official Journal on 22 June 2020 and adopted on 12 July 2020.

Whereas the Sustainable Finance Disclosure Regulation (SFDR) is intended to steer investments into sustainable economic activity, the EU Taxonomy determines which economic activities are really “sustainable”.

Article 8 of the Taxonomy Regulation compels enterprises covered by the current Non-Financial Reporting Directive – as well as any new companies covered by the CSRD – to report on the sustainability of their operations. Companies will be required to submit these metrics in addition to other sustainability data required by the CSRD.

Hence, these three regulations are inextricably linked: corporations subject to CSRD are required to make Taxonomy-related disclosures; their reporting is routed via financial market participants, who are subject to SFDR reporting obligations that include Taxonomy-related disclosures as well.

As a result, concerned firms may anticipate increased pressure from investors to publish sufficient sustainability information in accordance with the CSRD and the EU Taxonomy.

Intertwining of the 3 key regulations on non-financial reporting in Europe:

.avif)

Objectives

The CSRD aims to build upon the existing objectives of the NFRD.

The following are the aims of the proposal:

- Requiring that reported information be compatible with EU legislation, including the EU Taxonomy, be comparable, trustworthy, and simple for interested parties to access and utilise using digital technologies.

- Eliminating wasteful expenditures and allowing businesses to fulfill the rising demand for sustainability reporting in a cost-effective way.

CSRD's conceptual guidelines

CSRD provides guidelines on how to take into account certain key concepts:

Information quality

Requirements on how to ensure quality of sustainability data (e.g truthful representation, comparability, verifiability, etc.).

Double Materiality

Determining both the importance of sustainability issues on the company’s performance (i.e. financial materiality) and the external impacts of the company’s activities on the economy, the environment and people (i.e. impact materiality). The EFRAG will provide a methodology for identifying material issues.

Time horizon

The reporting period for sustainability information should be consistent with the one retained for financial statements, with additional retrospective and forward-looking information.

Boundaries and value chain

Sustainability data should cover direct and indirect business relationships in the upstream and/or downstream value chain.

In November 2022, the EFRAG approved the final version of the ESRS, which detail disclosure requirements. Overall, these requirements have been considerably reduced in this final version: the number of disclosure requirements has been reduced from 136 to 84 and the number of quantitative and qualitative data points has been reduced from 2,161 to 1,144.

CSRD's scope of application

The CSRD will broaden the scope of sustainability reporting obligations to include all major businesses that do not meet the NFRD’s existing 500-employee criterion.

All significant firms will be held publicly responsible for their effect on people and the environment as a consequence of this evolution. NFRD applies to “large” public interest entities (“PIEs”).

PIEs are classified as those organisations who have had more than 500 workers in the prior financial year.

The NFRD also absolves subsidiaries from reporting responsibilities if that entity’s parent firm agrees to perform the reporting obligations on behalf of the whole group.

Once operational, the CSRD would expand non-financial reporting obligations to big private corporations as well as those listed on EU regulated markets.

Approximately 12,000 businesses are presently subject to the Non-Financial Reporting Directive.

The European Commission predicts that this figure might climb to around 49,000 under the CSRD, owing to the greater definition of “large undertaking” under the Directive, as opposed to the large PIEs under the Non-Financial Reporting Directive.

1. EU-based companies:

CSRD has been established to encompass all major and publicly traded corporations operating on EU-regulated marketplaces (except for micro-enterprises).

Companies who fulfill two of the three requirements outlined below will be required to comply with the CSRD:

- Net turnover of more than €40 million

- Balance sheet assets greater than €20 million

- More than 250 employees

Small and medium-sized enterprises (SMEs) listed on the EU regulated markets have to comply with the CSRD but on an extended schedule.

2. Non-EU based companies:

The CSRD also extends to non-EU companies with EU subsidiaries and those listed on EU-regulated markets. Specifically, it applies to non-EU companies with a net turnover exceeding €150 million in the EU, broadening its scope beyond just EU-based firms.

.avif)

Practical requirements under CSRD

The following are the most paramount implications brought forward by CSRD:

A broader scope compared to NFRD

The CSRD broadens the scope to include all major firms and all publicly traded companies on regulated marketplaces (except listed micro-enterprises).

Mandatory audit

The CSRD requires third-party auditing (assurance) of reported information while it was optional under NFRD.

Digital format

The CSRD requires businesses to digitally 'tag' reported information, making it machine-readable and feeding into the European single access point envisaged in the capital markets union action plan. Important data will need to be “tagged” or given a “digital label” in order for algorithms to read it more quickly and for stakeholders to exploit and evaluate it.

Increased requirements

The CSRD increases reporting requirements and standardisation of disclosure, including a requirement to report in accordance with mandatory EU sustainability reporting standards that are in the process of being finalised. This will allow comparability of data between disclosing companies.

Information that should be disclosed by companies

Under CSDR, the Commission currently suggests that obligatory disclosures be included in a company’s management report and address three reporting areas:

1. Strategy

- Business model and strategy

- Primary risks regarding sustainability issues and dependencies

- Management and supervisory bodies' roles in relation to sustainability

2. Implementation

- Due diligence procedures for operations and the supply chain

- Policies addressing sustainability factors

- Sustainability targets

3. Performance

- Indicators pertinent to measuring all of the above

- Progress toward meeting targets

The CSRD covers all ESG criteria: environmental, social and governance issues.

In particular, the first set of European Sustainability Reporting Standards (ESRS) reviewed on November 2022 address the following 10 ESG topics:

Environment

- Climate change

- Pollution

- Water and marine resources

- Biodiversity and ecosystems

- Circular economy and resource use

Social

- Own workforce

- Workers in the value chain

- Affected communities

- Consumers and end-users

Governance

- Business conduct

Additionally, there are two ESRS covering general criteria—general requirements and general disclosures—that are mandatory for all organisations.

Lastly, three levels of information are expected:

Mandatory industry-agnostic disclosures:

They have been specified by EFRAG in the cross-cutting ESRS mentioned above.

Mandatory industry-specific disclosures:

While the European Commission initially aimed to adopt these sector-specific standards by June 2024, the deadline has been extended to 2026 to allow for more comprehensive development and consultation.

Company-specific information:

On issues that the company considers important and that have not been covered in the rest of the sustainability report.

How to prepare for CSRD

Given the breadth and reach of this law, most companies are likely to be seriously affected, as per the EFRAG standards released in late 2022.

For companies that have recently been included in the scope of CSRD, there are several steps to take to facilitate this transition. Businesses will want to get acquainted with the proposal itself and the actual implications of its needs for their firm.

The board of directors should ensure that the management team adequately prepares and plans the firm's operations for the new directive’s implementation.

While the board of directors will oversee the company’s preparations on a broad scale, the audit committee will play a critical role.

It should supervise the establishment of any new measurement and reporting procedures and the efficacy of the systems and controls in assuring the robustness of the information provided.

Since the sustainability reporting requirements are still being developed, businesses will need to begin preparations without knowing detailed requirements.

As a result, businesses should stay informed of any EFRAG findings, interpretations, and communications that provide early insight into how the standards will likely appear.

What is certain right now is that companies need to work on their ESG risks / double materiality analysis and then identify existing policies and KPIs covering those risks, and if none, close the gaps by formalising new ones.

Penalties for non-compliance with CSRD

Each Member State will define penalties for infringements to the CSRD.

The EU Commission has specified that sanctions must be “effective, proportionate and dissuasive” in its draft proposal.

This is generally consistent with the present NFRD. However, the CSRD goes further, requiring member states to implement the following (administrative) measures as well:

- a public declaration describing the infraction and identifying the guilty person/entity;

- a cease-and-desist order against the accountable person/entity;

- an administrative pecuniary penalties against the responsible person/entity.

Audit Requirements

The CSRD proposal establishes a common EU-wide audit requirement for sustainability data that has already been submitted, assisting in ensuring that provided data is accurate and credible.

While the European Commission’s purpose is to achieve a comparable degree of certainty for financial and sustainability reporting, it has allowed for a gradual approach.

Initially, auditors should give an opinion predicated on a “limited assurance” involvement with the sustainability reporting’s compliance with the CSRD’s criteria, including relevant reporting standards.

It is envisaged that the “limited” guarantee will be changed to a “reasonable assurance” at a later date, after the publication of the sustainability criteria and a review by the European Commission within three years of the CSRD taking effect.

Costs of CSRD

It is projected that preparers would spend considerable one-time fees as well as recurrent yearly costs in order to comply with the regulation.

The suggestion emphasises that corporations are already facing an increasing financial burden as a result of stakeholders demand for sustainability information.

As a consequence, depending on their size, businesses might realise significant savings by implementing the standards, since the standards eliminate the need for further information requests.

Next steps

- July 2023 - The European Commission adopted the first set of 12 European Sustainability Reporting Standards (ESRS), establishing a standardised framework for sustainability disclosures under the Corporate Sustainability Reporting Directive (CSRD). These initial standards set the foundation for comparable and reliable corporate sustainability reporting across the EU.

- January 2024 - Companies currently subject to the Non-Financial Reporting Directive (NFRD)—primarily large, publicly listed companies with over 500 employees—must begin reporting per the CSRD’s enhanced requirements. This includes disclosures on environmental, social, and governance (ESG) impacts, as well as on risks and opportunities related to sustainability.

- January 2025 - CSRD reporting obligations will expand to include a broader set of large companies that meet at least two of the following criteria: 250 or more employees, €40 million or more in net turnover, or a balance sheet total of at least €20 million. This extends sustainability reporting requirements to privately held large companies, promoting greater transparency across different ownership structures.

- January 2026 - Listed small and medium-sized enterprises (SMEs) with 10 to 250 employees will be required to report under the CSRD, though they may opt for a deferral of up to three years. During this deferral period, SMEs can follow a simplified standard, balancing the need for transparency with considerations of their typically more limited resources.

- By June 2026 - The European Commission is expected to release sector-specific sustainability reporting standards. These guidelines will provide tailored reporting requirements for high-impact sectors, such as energy, transportation, and finance, addressing the unique sustainability challenges and risks within each industry.

- January 2028 - European subsidiaries of non-European companies with an annual turnover of more than €150 million within the EU will also be required to report under the CSRD. This requirement aims to ensure consistent reporting standards for multinational companies operating within the EU, fostering accountability for sustainability impacts and risks regardless of a company’s headquarters location.

- Post-2028 - Future revisions to the CSRD may occur based on the evolving landscape of sustainability and corporate reporting. This could include adjustments to the reporting requirements, expansion of the scope to cover additional sectors, or updates to align with international sustainability frameworks and standards, such as the Global Reporting Initiative (GRI) or the International Sustainability Standards Board (ISSB).

In conclusion…

As regulations become more stringent and the business world becomes more socially and environmentally aware, ESG practices will be mandated.

If your company must comply with the CSRD, you should begin immediately. The deadline is coming up fast, and the fines for noncompliance can be steep.

But it can be a time-consuming and complex process. And that’s where we come in to help!

Apiday provides a platform that simplifies the data collection process of sustainability metrics and unlocks seamless collaboration.

So you can focus on what matters the most: driving change in your company rather than fetching and crunching data!

And we also extend our support to the Sustainable Finance Disclosure Regulation (SFDR) and EU Taxonomy.

Take the first step towards compliance excellence and try our tool today!

If your company must comply with CSRD, you should begin immediately!

Our cutting-edge tool is here to guide you on the right compliance track, gathering data and automating the creation of disclosure reports. With everything you need to be fully compliant in a single platform, take the first step towards CSRD compliance now!

Frequently Asked Question

The CSRD is a European regulation and will affect organisations that have a listing on a regulated market in the European Union or that reach certain thresholds (number of employees, turnover, balance sheet).

The CSRD aims to build upon the existing objectives of the NFRD. The CSRD will broaden the scope of sustainability reporting obligations to include all major businesses that do not meet the NFRD’s existing 500-employee criterion. As part of the CSRD, financial and sustainability information will be released simultaneously within the management report.

The CSRD will indeed expand corporate sustainability reporting that have a listing on a regulated market in the European Union or that reach certain thresholds (number of employees, turnover, balance sheet).

Sources

Related articles

What is CSR (Corporate social responsibility) and how to adopt it?

CSR is an abbreviation for Corporate Social Responsibility. CSR strategies have become common in today’s corporate world as more and more companies realise that their business performance and its societal impacts are intricately connected.