How Are EU Taxonomy and SFDR Related? A Dive into Sustainable Finance

The European Union (EU) has been at the forefront of promoting responsible investment as part of its broader European Green Deal, an ambitious strategy aimed at making Europe the first climate-neutral continent by 2050.

Central to this initiative are two key regulatory frameworks: the EU Taxonomy and the Sustainable Finance Disclosure Regulation (SFDR).

These frameworks not only define what constitutes sustainable finance but also enforce rigorous and harmonised standards to ensure that financial products align with the EU’s environmental and social objectives.

In this article, we’ll explore the interplay between the EU Taxonomy and SFDR, to provide a deeper understanding of their distinct roles and how their synergy is crucial in advancing the EU’s green agenda.

What is the SFDR?

The Sustainable Finance Disclosure Regulation (SFDR) is a European Union regulation that imposes mandatory ESG (Environmental, Social, and Governance) disclosure requirements on asset managers and other financial market participants (FMPs) that have been in effect since March 10, 2021.

The primary objective of the SFDR is to establish a level playing field among FMPs and financial advisors by enhancing transparency around sustainability risks, the consideration of adverse sustainability impacts in investment decisions, and the disclosure of sustainability-related information about financial products.

.avif)

The SFDR aims to remove barriers that prevent access to essential sustainability data, enabling asset managers and investors to make informed decisions. It mandates comprehensive disclosure at both the entity and product levels, fostering consistency across the EU financial markets.

It pursues three main goals:

- Improve disclosures so institutional investors and retail customers can better understand, compare, and monitor the sustainability aspects of financial products and organisations;

- Ensure a level playing field within the EU by protecting European enterprises from unfair competition with non-EU firms;

- Address greenwashing.

How does the SFDR work?

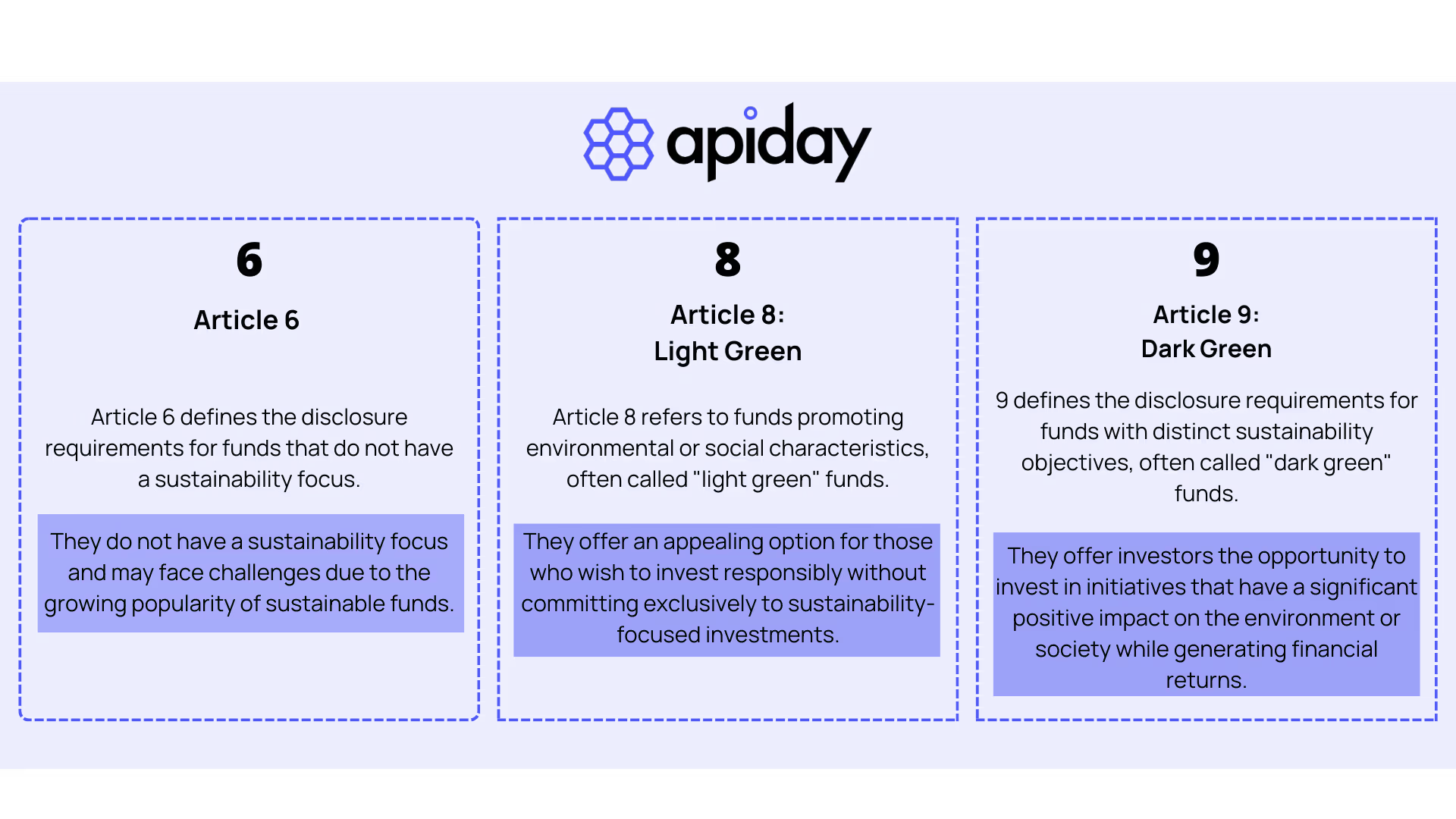

The SFDR defines three separate kinds of investment products in terms of sustainable investing and environmental, social, and governance (ESG) considerations:

At the entity level, financial market participants must explain and disclose the following:

- Risk management for sustainability and integration of sustainability risks into the investment decision-making process.

- Alignment of compensation plans with sustainability risks

- Cconsideration of principal adverse impacts (PAIs) of the investment decisions and/or investment advice on sustainability factors

This information must primarily be disclosed on the website of the financial market participant or financial advisor.

At the financial product level, the following items need to be explained and disclosed:

- The article under which the fund is classified (Article 6, 8, or 9)

For article 8 and 9 funds:

- Risk management for sustainability and integration of sustainability risks into the investment decision-making process

- Consideration of PAIs of the investment decisions and/or investment advice on sustainability factors

- Do No Significant Harm i.e. ensuring portfolio companies’ activities are not negatively affecting any sustainability factor

- Alignment with minimum safeguards and good governance practices by all portfolio companies

What is the EU Taxonomy?

The EU Taxonomy is a cornerstone of the European Union’s sustainable finance framework, serving as a classification system that identifies which economic activities can be considered environmentally sustainable. It entered into force on July 12, 2020.

By establishing clear criteria, the EU Taxonomy provides essential guidance for companies, capital markets, and policymakers on sustainability standards. It sets the benchmark for environmental sustainability, thereby creating a unified language that all stakeholders can rely on.

This system plays a crucial role in safeguarding against greenwashing by ensuring that investments labelled as "sustainable" genuinely meet the required environmental criteria.

Additionally, the EU Taxonomy aids in scaling up sustainable investments across the EU by fostering a consistent and transparent framework for both investors and companies.

How does the EU Taxonomy work?

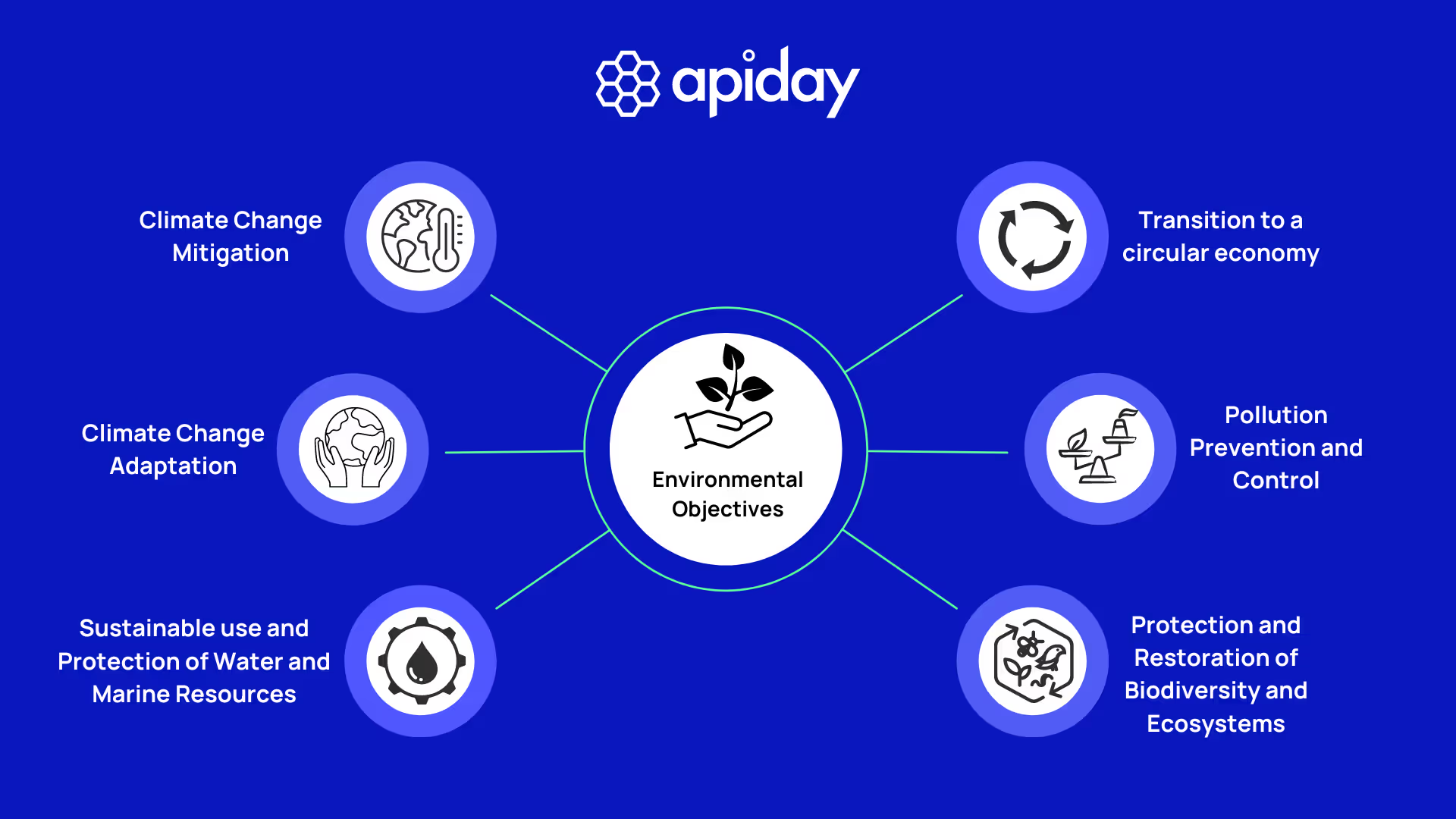

For an activity to be deemed sustainable under the EU Taxonomy, it must:

- Contribute Substantially: align with one or more of the six environmental objectives.

- Do No Significant Harm: avoid causing significant harm to any of the other environmental objectives.

- Meet Minimum Social Safeguards: comply with fundamental social standards, such as upholding basic human rights and labour practices, in alignment with the OECD Guidelines for Multinational Enterprises and the UN Guiding Principles on Business and Human Rights.

-> To qualify under these criteria, the activity must comply with Technical Screening Criteria (TSC): each objective has a set of “technical screening criteria” (TSC) detailing the specific thresholds and requirements for each activity to be considered as significantly contributing to a sustainability objective.

Relationship Between EU Taxonomy and SFDR

Data shows that investors increasingly prioritise sustainability in their investment choices, underscoring the rise in demand for transparent and credible sustainability data.

The EU Taxonomy and SFDR are interconnected, working together to advance sustainable finance by offering clear guidelines and enhancing transparency. Both frameworks are designed to improve transparency, curb greenwashing, and ensure that investments are genuinely sustainable.

The EU Taxonomy establishes the standards for what qualifies as a sustainable activity, while the SFDR mandates that financial entities disclose their alignment with these standards. Under the SFDR, financial products are required to detail how they conform to the EU Taxonomy, providing investors with clear information on the extent to which their investments are directed toward taxonomy-aligned activities.

This alignment allows for a more effective comparison of financial products based on their environmental impact, contributing to a more transparent and trustworthy market.

How should fund managers comply with the EU Taxonomy?

A significant portion of European investment funds are now classified under Article 8 or Article 9 of the SFDR, reflecting the growing emphasis on sustainability in the financial sector.

Fund managers who are subject to the Sustainable Finance Disclosure Regulation (SFDR) are required to comply with EU Taxonomy disclosures when their financial products are marketed as environmentally sustainable.

Article 8 funds

An Article 8 fund, under the SFDR, is a fund that promotes environmental or social characteristics but does not necessarily have sustainability as its core objective, unlike Article 9 funds.

For Article 8 funds that promote environmental characteristics, the EU Taxonomy disclosures are applicable because these funds must disclose how and to what extent the investments underlying the fund are aligned with the environmental objectives of the EU Taxonomy.

If an Article 8 fund primarily promotes social characteristics and does not focus on environmental characteristics, it is not obligated to align with or disclose against the EU Taxonomy’s environmental objectives. However, if the fund does have any underlying investments that contribute to environmental objectives, even if not directly promoted, it may voluntarily choose to disclose alignment with the EU Taxonomy.

Article 9 funds

Article 9 funds have sustainable investment or the reduction of carbon emissions as their primary goal. The EU Taxonomy disclosures specifically apply to Article 9 funds that are characterised by environmental objectives. However, these disclosures can also be relevant for Article 9 funds that are focused on social objectives, as long as the fund also contributes to an environmental objective in some manner.

This means that even if the primary focus of an Article 9 fund is on social issues, such as promoting social inclusion or labour rights, if the fund also aligns with or contributes to one or more of the environmental objectives set out in the EU Taxonomy, the fund manager must provide disclosures on how and to what extent the investments meet the technical screening criteria for those environmental objectives.

{{encartSpecial}}

Disclosure requirements

Key dates

The obligation to comply with EU Taxonomy disclosures began in phases:

- From January 1, 2022: fund managers were required to disclose the extent to which their products are aligned with the climate change mitigation and climate change adaptation objectives of the EU Taxonomy.

- From January 1, 2023: fund managers must also disclose alignment with the remaining four environmental objectives of the EU Taxonomy: sustainable use and protection of water and marine resources, transition to a circular economy, pollution prevention and control, and protection and restoration of biodiversity and ecosystems. This expansion coincided with the implementation of SFDR Level 2.

→ SFDR Level 2, also known as the Regulatory Technical Standards (RTS) builds upon the initial principles set out in SFDR Level 1, which began in March 2021.

What are the EU Taxonomy disclosures?

Pre-Contractual and Periodic Disclosures are critical components of the EU Taxonomy regulation, designed to provide transparency about the environmental sustainability of financial products.

These disclosures must include detailed, standardised information that demonstrates how, and to what extent, financial products align with the EU Taxonomy’s environmental objectives.

1. Pre-Contractual Disclosures:

Pre-contractual disclosures play a pivotal role in informing potential investors about the environmental characteristics of financial products before they make investment decisions.

These disclosures must clearly state the minimum percentage of a fund's assets that are aligned with the EU Taxonomy.

The alignment should be presented in a visually accessible format, which illustrates the proportion of investments contributing to the taxonomy’s environmental objectives. The key metrics typically used to express this alignment include:

- Turnover: the percentage of revenue generated from activities that qualify as environmentally sustainable according to the EU Taxonomy.

- Capital Expenditures (CapEx): investments in assets or projects that contribute to the transition towards a more sustainable economy.

- Operational Expenditures (OpEx): ongoing expenses related to activities that support environmental sustainability.

Fund managers are encouraged to use the metric most appropriate to their specific fund, but they must ensure that the chosen metric accurately reflects the environmental impact of the fund's investments.

2. Periodic Disclosures:

Periodic Disclosures, typically provided annually, must offer a comprehensive assessment of the fund's performance concerning its environmental objectives.

These disclosures need to update investors on the actual level of taxonomy alignment achieved during the reporting period.

Unlike pre-contractual disclosures, periodic disclosures should provide a more detailed analysis using all three financial figures—turnover, CapEx, and OpEx. Information is presented in a visible accessible way, comparing the fund's initial taxonomy alignment targets with the actual outcomes over the reporting period.

Key elements to include in Periodic Disclosures are:

- Updated taxonomy alignment: reflecting any changes in the proportion of the fund's assets that align with the taxonomy's objectives.

- Performance comparison: a side-by-side comparison of the fund's original alignment projections and the actual results, helping investors gauge the effectiveness of the fund's sustainability strategy.

- Impact of any changes: if there have been significant changes in alignment due to portfolio adjustments, these must be documented and explained.

Both Pre-Contractual and Periodic Disclosures require ongoing monitoring and regular updates to ensure transparency and accuracy. Any material changes in the fund’s alignment with the EU Taxonomy objectives must be promptly reflected in the disclosures, ensuring that investors are always equipped with the most current information.

“Minimum Alignment” Definition

The concept of "minimum alignment" pertains to the lowest percentage of a fund's investments that must satisfy the environmental sustainability criteria established by the EU Taxonomy.

This percentage represents the portion of the fund's underlying investments—whether in terms of turnover, capital expenditures (capex), or operational expenditures (opex)—that aligns with the specific environmental objectives defined by the EU Taxonomy.

Fund managers are obligated to disclose this "minimum alignment" in pre-contractual documents. This disclosure provides potential investors with a clear baseline of the fund’s sustainability performance, ensuring they understand the extent to which the fund’s investments contribute to environmental goals.

However, without reliable and verifiable data, a fund cannot claim alignment with the EU Taxonomy, regardless of its stated objectives or strategies. Fund managers are prohibited from making speculative claims in their disclosures; they must base their statements on credible, verifiable data.

For example, if a fund manager reports that 30% of the fund is aligned with the EU Taxonomy, this indicates that 30% of the fund’s investments substantially contribute to one or more of the Taxonomy’s environmental objectives.

This concept is vital for ensuring transparency and maintaining the integrity of funds marketed as sustainable.

Challenges

Despite the intention of these regulations, confusion persists. For instance, while Article 8 funds are designed to promote environmental or social characteristics, the extent of their adherence to EU Taxonomy disclosures can be unclear, particularly when their primary focus is social rather than environmental aspects.

Similarly, Article 9 funds, which are expected to have a stronger commitment to sustainability, might encounter difficulties in determining how closely they need to align with the EU Taxonomy, particularly when their objectives encompass both environmental and social goals.

These overlapping and sometimes vague requirements could lead fund managers to interpret the regulations differently, potentially resulting in inconsistencies in reporting and compliance across the sector.

This initial uncertainty underscores the need for further guidance and clarification from regulatory authorities. Such guidance is essential for ensuring that fund managers can effectively meet their disclosure obligations while aligning with the expectations of both the SFDR and the EU Taxonomy.

Conclusion

The EU Taxonomy and SFDR are foundational pillars of the EU's sustainable finance strategy, working together to enhance transparency, combat greenwashing, and promote sustainable investments.

However, navigating compliance with these regulations can be complex and time-consuming— this is where Apiday comes into play!

We support VC and PE firms at every stage of the SFDR compliance process, from collecting and managing portfolio data to automating the creation of disclosures and PAI statements.

But that's not all: our platform features a powerful EU Taxonomy module that enables you to reuse data across multiple reports, eliminating redundant data entry. From eligibility screening and alignment to generating the required Regulatory Technical Standards (RTS) reports, everything you need is accessible in one integrated solution.

Ready to simplify your compliance process? Get started with Apiday today and ensure your firm meets all regulatory requirements with ease. Book a no-obligation demo and see how Apiday can help you stay ahead in sustainable finance.

Achieve both SFDR and EU Taxonomy compliance

Our platform simplifies data collection, analysis, and integrates seamlessly with EU Taxonomy and SFDR. Let us take the hassle out of compliance—try our tool today!

Frequently Asked Question

The EU Taxonomy is a classification system that defines environmentally sustainable economic activities. It provides a standardised framework for determining which activities contribute significantly to environmental goals, such as climate change mitigation and adaptation. Its importance lies in enhancing transparency and preventing greenwashing, thereby guiding investors towards truly sustainable investments and supporting the EU’s transition to a low-carbon economy.

The SFDR mandates detailed disclosures from financial market participants about the sustainability risks and impacts of their investment products. It requires both entity-level and product-level disclosures, ensuring that investors receive clear, comparable information about how investments align with sustainability criteria. This enhanced transparency helps prevent greenwashing and enables investors to make more informed decisions based on the sustainability characteristics of financial products.

The EU Taxonomy and SFDR are interconnected in promoting sustainable finance. The EU Taxonomy provides the criteria for what constitutes a sustainable activity, while the SFDR requires financial entities to disclose how their investments align with these criteria. This relationship ensures that financial products marketed as sustainable under the SFDR meet rigorous standards defined by the Taxonomy, fostering greater transparency and comparability in the market.

Sources

Related articles

What is CSR (Corporate social responsibility) and how to adopt it?

CSR is an abbreviation for Corporate Social Responsibility. CSR strategies have become common in today’s corporate world as more and more companies realise that their business performance and its societal impacts are intricately connected.